The Importance of VAT Compliance for Small Businesses

Image Source: Yandex.com.

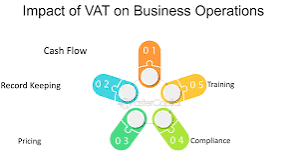

Value Added Tax (VAT) is a tax levied on the sale of goods and services, and while it is a standard component of business operations in many countries, VAT compliance is particularly crucial for small businesses. Properly managing VAT obligations is not just about adhering to legal requirements; it also plays a significant role in maintaining the financial health and reputation of a small business. This blog explores why VAT compliance is essential for small businesses and offers insights into how to effectively manage VAT responsibilities. For specialized support in handling your VAT obligations, consider utilizing VAT Return Services London to ensure accuracy and compliance in your filings.

What is VAT Compliance?

VAT compliance refers to the adherence to the rules and regulations set out by tax authorities regarding the collection, reporting, and payment of VAT. For small businesses, this involves several key responsibilities, including:

- Charging VAT: Ensuring that VAT is added to invoices correctly and at the appropriate rate.

- Recording Transactions: Keeping accurate records of all transactions subject to VAT.

- Filing Returns: Submitting VAT returns to tax authorities within specified deadlines.

- Paying VAT: Paying any VAT due to the tax authorities on time.

Failure to comply with VAT regulations can lead to serious consequences, including fines, penalties, and legal issues. For small businesses, these repercussions can be particularly damaging, both financially and reputationally.

The Financial Impact of VAT Compliance

Avoiding Penalties and Fines: Non-compliance with VAT regulations can result in significant financial penalties and fines. Tax authorities are stringent about VAT compliance, and businesses that fail to meet their obligations may face audits, fines, and interest on unpaid VAT. For small businesses, these additional costs can strain limited financial resources.

Maintaining Cash Flow: Proper VAT management helps in maintaining healthy cash flow. Businesses need to ensure that they have sufficient funds to cover VAT liabilities when they become due. Accurate VAT invoicing and timely payment help prevent cash flow issues that can arise from unexpected tax demands.

Improving Financial Planning: Effective VAT compliance contributes to better financial planning. By accurately recording and reporting VAT, businesses can better forecast their financial position and manage their budgets. This helps in making informed business decisions and planning for future growth.

The Reputational Impact of VAT Compliance

Building Trust with Customers: Compliance with VAT regulations enhances a business’s reputation for reliability and integrity. Customers and clients are more likely to trust a business that adheres to tax laws and operates transparently. This trust can lead to stronger customer relationships and potentially more business opportunities.

Avoiding Legal Issues: VAT non-compliance can lead to legal disputes and complications. Businesses may face legal actions from tax authorities or be involved in lengthy and costly legal proceedings. Maintaining compliance helps avoid these legal issues and protects the business’s reputation and operational integrity.

Managing VAT Compliance Effectively

Understanding VAT Requirements: Small business owners must familiarize themselves with VAT regulations specific to their country or region. This includes understanding the VAT rates applicable to different goods and services, knowing the deadlines for VAT returns, and being aware of any exemptions or special rules that may apply.

Implementing Robust Record-Keeping Practices: Accurate and organized record-keeping is crucial for VAT compliance. Businesses should maintain detailed records of all transactions, including sales and purchases, along with VAT invoices. This helps ensure that VAT returns are accurate and that any potential audits can be managed smoothly.

Using Accounting Software: Accounting software can simplify VAT management by automating calculations, generating VAT reports, and tracking transactions. Many software solutions are designed to help businesses comply with VAT regulations and streamline the filing process, reducing the risk of errors and omissions.

Consulting with Tax Professionals: Engaging with tax professionals or accountants who specialize in VAT can provide valuable guidance. These experts can help ensure that your business complies with VAT laws, assist with VAT planning, and provide advice on handling complex VAT issues.

Regularly Reviewing VAT Procedures: Regular reviews of VAT procedures and practices help ensure ongoing compliance. Businesses should periodically assess their VAT processes, update their records, and stay informed about any changes in VAT regulations or rates that may affect their operations.

The Benefits of VAT Compliance for Small Businesses

Enhanced Business Efficiency: Proper VAT management contributes to overall business efficiency. By streamlining VAT processes and ensuring compliance, small businesses can focus more on their core operations and strategic goals, rather than dealing with tax-related issues.

Access to VAT Refunds: Compliant businesses are entitled to claim VAT refunds on certain expenses and purchases. Effective VAT management ensures that businesses can take advantage of these refunds, which can provide a financial boost and improve cash flow.

Confidence in Business Operations: Knowing that VAT obligations are handled correctly gives business owners confidence in their operations. This peace of mind allows them to concentrate on growing their business and pursuing new opportunities without the worry of potential tax problems.

Conclusion

VAT compliance is not merely a regulatory requirement but a fundamental aspect of managing a successful small business. Adhering to VAT laws and regulations helps avoid penalties, supports financial planning, and enhances the business’s reputation. Effective VAT management involves understanding requirements, maintaining accurate records, utilizing accounting software, and seeking professional advice. For expert assistance, Clarkwell & Co. Accountants can provide valuable guidance to ensure your business meets all VAT obligations. For small businesses, ensuring VAT compliance can be a key factor in sustaining operations, fostering customer trust, and achieving long-term success. By prioritizing VAT compliance and implementing sound practices, small business owners can navigate the complexities of VAT with confidence and focus on what matters most—their business’s growth and prosperity.If you want to stay updated with posts like this, please follow us